ANALISIS HUKUM PENERAPAN ANTI PENCUCIAN UANG TERHADAP KEBIJAKAN RAHASIA BANK

DOI:

https://doi.org/10.25123/vej.v2i1.2071Abstract

This article discusses money laundering and the implementation of Customer Due Diligence (CDD) which is to be understood as part of the effort to eradicate this particular crime. Money laundering is not an autonomous crime but is always related or stems from an original crime (predicate crime). This crime is committed habitually using financial institution or banks as its instrument. One factor making this possible is the obligation of bank to guard and maintain customer’s trust by virtue of bank’s secrecy. Nonetheless, this bank secrecy can be waived. By virtue of CDD, banks are under the obligation to implement a process of customer identification, including verification- monitoring of customers financial transaction or activities. In the case, they detect suspicious financial transactions the banks are under the obligation to report their findings to the Indonesian Financial Transaction Reports and Analysis Centre (INTRAC) and/or law enforcement officers

Keywords:

money laundering, bank, customer due diligence, anti-money laundering program and bank secrecyDownloads

Published

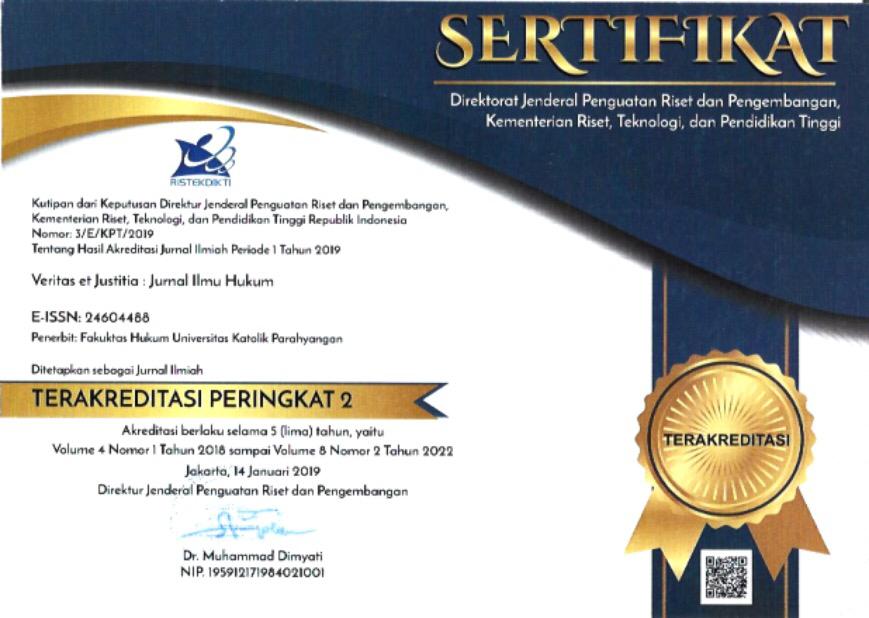

Issue

Section

License

Authors who publish with this journal agree to the following terms:

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

The Journal allow the author(s) to hold the copyright and to retian publishing rights without restrictions.