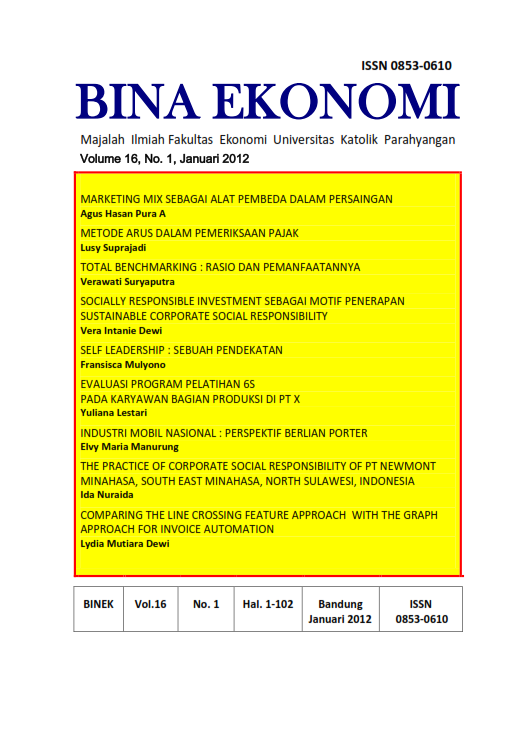

METODE ARUS DALAM PEMERIKSAAN PAJAK

DOI:

https://doi.org/10.26593/be.v16i1.791.%25pAbstract

Self assessment system is implemented in fulfilling income tax obligation, especially in preparing tax return. Tax audit is done to examine the validity of tax return which is compiled by tax payer himself. Audit methodology which is used in tax audit differs from financial statement audit. Tax auditor using flow method, as a part of tax audit methodology, to detect fraud in tax reporting. Unsynchronize among data flow of account receivable, account payable, cash and bank, and inventory will cause potential risk in tax administrative sanction. If these are occured, tax auditor will assume that tax payer has done fraudulent financial reporting in taxation.Key words: Flow Method, Tax Audit, Fraudulent Financial Reporting