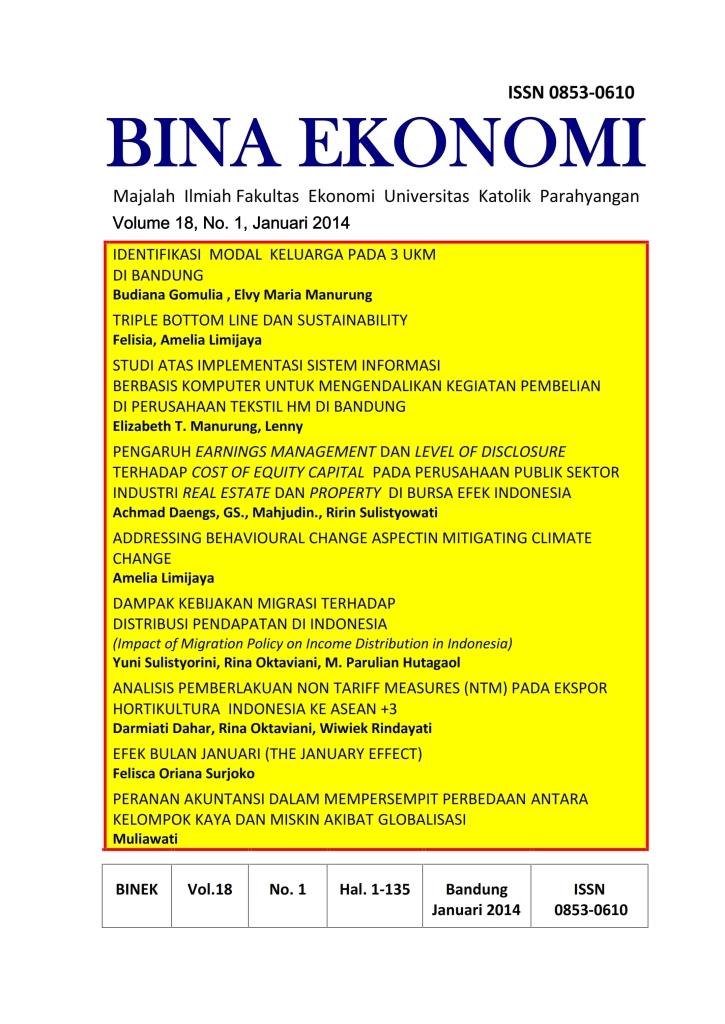

EFEK BULAN JANUARI (THE JANUARY EFFECT)

DOI:

https://doi.org/10.26593/be.v18i1.822.%25pAbstract

The dynamics of stock market could be an opportunity for investor to earn profit form their portfolio. Investors who actively observe the stock price movement find certain phenomena called anomaly. It is happened when the stock prices move unreasonable. Those events can be a moment to earn abnormal returns. January effect happens when the stock prices rise in January compared to other months. This becomes an opportunity for investors to gain abnormal returns by selling their shares when prices go up. Several previous studies have been conducted to prove the existence of the January effect in some stock markets. But not a few people deny the existence of January effect. The controversy of the January effect existence brings some changes in investor behavior. There is no guarantee that the anomalous moment will be profitable for investors therefore investors need to be careful. Implementing good strategic timing of buying and selling is a key success to gain return from this phenomena.