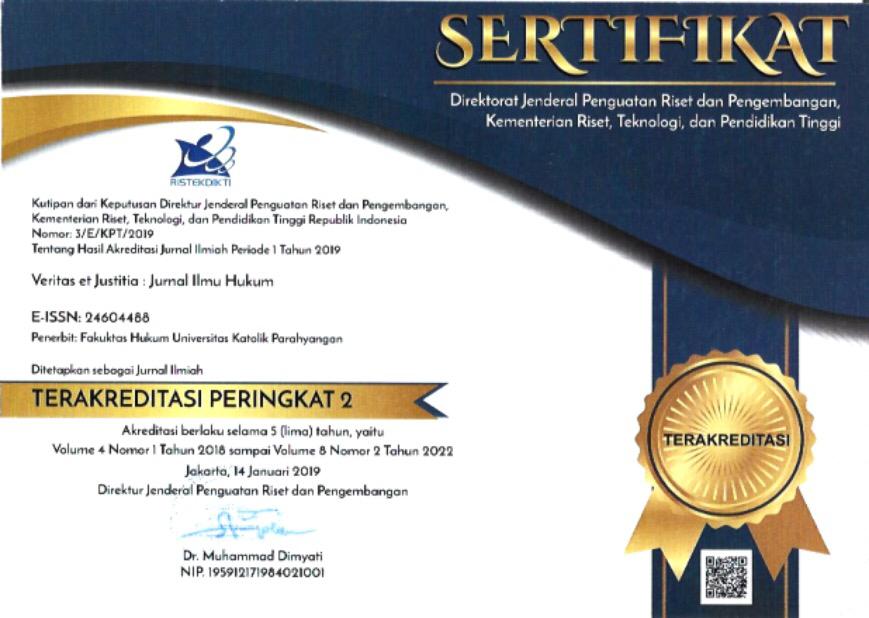

CONCRETISATION OF THE PRINCIPLE OF SUSTAINABLE FINANCE IN THE BANKING SECTOR LEGISLATION IN INDONESIA: LON FULLER EIGHT DESIDERATA APPROACH

DOI:

https://doi.org/10.25123/vej.v5i2.3626Abstract

This article aims is to explores an issue where Sustainable finance itself is a form of embodiment in Article 33 paragraph (4) of the 1945 Constitution of the Republic of Indonesia that the national economy is organized based on several principles, one of which is sustainable principles by maintaining a balance and unity of the national economy. Thus Article 33 paragraph (4) of the 1945 Constitution of the Republic of Indonesia is a juridical basis of sustainable finance that promotes a sustainable financial system. The research methodology was an integration of empirical juridical research methods and interpretation of the normative method results. The results indicated that with the involvement of banks in implementing sustainable finance, banks must be selective in granting credit to debtors by setting conditions that are following bank policies. Because basically, sustainable finance activities do not harm the community, it creates justice for the community based on the constitutional rights of citizens to get a decent life. In the concept of sustainable finance, economic sustainability includes several criteria in carrying out credit risk analysis, including sustainability of resources, the sustainability of results and sustainability of the business.

References

References

Books:

Achmad, Ali,2002. Menguak Tabir Hukum, Gunung Agung, Jakarta

Bungin, Burhan,.Metodologi Penelitian Kualitatif : Aktualisasi ke Arah Ragam Varian Kontemporer, RajaGrafindo Persada, Jakarta

Coleman, William D., 1996, Financial Services, Globalization and Domestics Policy Change ; A Comparison of North America and The European Union, Macmillan Press, Hampshire

Djiwandono, J. Soedradjad, 2001, Bergulat dengan Krisis dan Pemulihan Ekonomi Indonesia, Pustaka Sinar Harapan, Jakarta.

------------, 2001, Mengelola Bank Indonesia dalam Masa Krisis, Pustaka LP3ES, Jakarta.

Djumhana, Muhammad, 2003, Hukum Perbankan di Indonesia, Citra Aditya Bakti, Bandung.

Fernando M. Manullang, Legism, Legality and Legal Certainty, Prenadamedia Group, Jakarta, 2016.

Fuady, Munir, 1999, Hukum Perbankan Modern : Berdasarkan Undang-Undang Tahun 1998, Edisi Kesatu, Citra Aditya Bakti, Bandung.

Friedman, Lawrence, 1975, The Legal System : A Social Science Perspektive, Rusell Sage Foundations, New York.

Friedman, Wolfgang, 1953, Legal Theory, London : Edisi Ketiga, Stevens & Sons Limited.

Hasibuan, Malayu S.P., 2006, Dasar-Dasar Perbankan, Bumi Aksara, Jakarta.

Hermansyah, 2006, Hukum Perbankan Nasional Indonesia, Edisi Revisi, Kencana Prenada Media, Jakarta.

Hopkins, Michael, 2003, The Planetary Bargain : Corporate Social Responsibility Matter, Earthscan, London

Hamzah Halim & Kemal Redindo Syahrul Putera, Practical Ways to Arrange & Design Regional Regulations, Kencana, Jakarta, 2009.

Isya Wahyudi dan Busyra Azheri, Corporate Social Responsibility Principles, Arrangements & Implementation, Setara Press, Malang, 2011

Jazim Hamidi, Participatory Academic Manual for PERDA Academic Script, Kreasi Total media, Yogyakarta, 2007

Maria Farida Indrati, Legislation Process and Formation Techniques, kanisius, Yogyakarta, 2007

Journals:

Dewantara, Reka, 2005, Dekonstruksi Prinsip Kehati-hatian Dalam Hukum Perbankan, dalam Maksigama, Jurnal Hukum, Universitas Wisnuwardhana Press, Malang

Hukum Bisnis, 2003, Urgensi Penegakan GCG Bagi Perseroan, Vol.22, No.6, Yayasan Pengembangan Hukum Bisnis, Jakarta.

-------------------, Korupsi Sistemik dan GCG Dalam Perspektif Hukum, Vol.24, No.3, Yayasan Pengembangan Hukum Bisnis, Jakarta.

-------------------, 2004, Penerapan Manajemen Risiko Bagi Lembaga Keuangan, Vol. 23, No. 3, Yayasan Pengembangan Hukum Bisnis, Jakarta.

------------------, 2005, Merebaknya Kejahatan Perbankan : Cermin Lemahnya Penegakan Hukum, vol. 24 No.1, Yayasan Pengembangan Hukum Bisnis, Jakarta,

Ivo, Županović, Sustainable Risk Management In The Banking Sector, Journal Of Central Banking Theory And Practice. 2014;3(1):81-100 DOI 10.2478/Jcbtp-2014-0006

Silalahi, Tumpak & Tevy Chawwa, Relative Effectiveness Of Indonesian Policy Choices During Financial Crisis, Bulletin Ekonomi Moneter Dan Perbankan. 2012;14(2):177-219 DOI 10.2, 1098/Bemp.V14i2.84

Internet :

Gunawan Widjaja, Lon Fuller : Law And Legal Interpretation, Law Review, Fakultas Hukum Universitas Pelita Harapan, Vol. VI. No 1 Juli 2006, (online) http://download.portalgaruda.org/article.php?article=391106&val=8576&title=Lon%20fuller,%20Pembuatan%20Undang-Undang%20dan%20%Penafsiran%20Hukum.

Downloads

Published

Issue

Section

License

Authors who publish with this journal agree to the following terms:

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

The Journal allow the author(s) to hold the copyright and to retian publishing rights without restrictions.