DUALISME KETENTUAN COST RECOVERY SEBAGAI DASAR PUNGUTAN NEGARA PADA INDUSTRI HULU MIGAS

DOI:

https://doi.org/10.25123/vej.v7i1.3740Keywords:

Corporate Income Tax, State-Revenue, Production Sharing Contract.Abstract

This article traces and describes the changes made from time to time, to the calculation and determination of government share, as obtained from corporate revenues and tax deducted based on Production Sharing Contract, as used in the Indonesian natural gas and oil sector. Qualitative data is gathered by performing a legal audit and literature review. The issue discussed here is the disagreement existing between the government and contractor regarding the calculation of recoverable cost (based on the Production Sharing Contract) and amount of corporate income tax imposed based on the prevailing tax law. Based on the review of legal materials and literature, the recommended action is to harmonize these two different tax-revenue schemes.

References

Buku:

A. Madjedi Hasan, Kontrak Minyak dan Gas Bumi Berazas Keadilan dan Kepastian Hukum, PT. Fikahati Aneska, Jakarta, 2009.

David Mellor, ed. Parthasarathi Some, Handbook of Tax Policy, Washington DC, International Monetary Fund, 2012.

D. Johnston, How to Evaluate The Fiscal Terms of Oil Contract in Escaping the Resource Curse: M. Humpreys, et.al.eds, Columbia University Press, UK. New York, 2007

Gordon Barrows, A Survey of Incentives in Recent Petroleum Contracts, in Petroleum Investment Policies in Developing Countries, ed. by Beredjick, N. and T. Wälde, Graham &Trotman, London, 1988.

Lubiantara Benny, Ekonomi Migas: Tinjauan Aspek Komersial Kontrak Migas, Grasindo, Jakarta, 2013.

Nakhle Carole, Petroleum Taxation Sharing the Oil Wealth: A Study of Petroleum Taxation Yesterday, Today and Tomorrow, Routledge Studies in International Business and the World Economy, 2008.

Nakhle Carole, Petroleum Fiscal Regime Evolution and Challenges, The Taxation of Petroleum and Minerals: Principle, Problems and Practice, Routledge, 2010

Philip Daniel, Evaluating State Participation in Mineral Projects: Equity, Infrastructure and Taxation, in Taxation of Mineral Enterprises, ed. by Otto, J., Graham & Trotman, London, 1995.

Rudi M. Simamora, Hukum Minyak dan Gas Bumi, cet. Ke-1, Dian Rakyat, Jakarta, 2000.

Thomas Baunsgaard, A Primer on Mineral Taxation”, IMF Working Paper 01/139, Washington, International Monetary Fund, 2001.

Widjajono, Migas dan Energi di Indonesia Permasalahan dan Analisis Kebijakan, Development Studies Foundation, Bandung, 2009.

Zhiguo Gao, International Petroleum Contracts: Current Trends and New Directions, Kluwer Academic Publisher, 1994.

Artikel dalam Jurnal:

Chandranegara I.S., Desain Konstitusional Hukum Migas untuk Sebesar-besarnya Kemakmuran Rakyat, Jurnal Konstitusi, Vol. 14, No. 4, 2017.

F. Kurniawan, Bentuk Perlindungan Hukum terhadap Kekayaan Minyak dan Gas Bumi sebagai Aset Negara Melalui Instrumen Kontrak, Jurnal Hukum dan Peradilan, Vol. 2, No. 3, 2013,

Kastella & Prabowo, Mekanisme Transparansi dan Akuntabilitas atas Cost Recovery Berdasarkan Production Sharing Contract Minyak dan Gas Bumi dari Kontraktor KKS ke Pemerintah Melalui SKK Migas, Jurnal Ekonomi dan Bisnis, Vol. 23, No. 1., 2020

Khairunissa, Tinjauan Hukum Internasional terhadap Pengelolaan Minyak dan Gas di Indonesia, Tadulako Law Review, Vol. 1, Issue 1, 2016.

Kurniasih, Pembaharuan Pengeloaan Penerimaan Negara Bukan Pajak, Media Pembinaan Hukum Nasional. Vol. 5, No. 2, 2016.

Mas’udin, Dinamika Perubahan Ekonomi Makro dan Dampaknya terhadap Pertumbuhan Penerimaan Pajak Penghasilan Non Migas, Jurnal Pajak Indonesia, Vol. 1, No. 1, 2017.

Puji Wibowo, Menyola Dualisme Kebijakan Penyetoran Penerimaan Negara Sektor Hulu Migas dan Gas Bumi, Jurnal Manajemen Keuangan Publik, Vol. 1, No.1, 2017.

Puji Wibowo, Menuju Kebijakan Akuntansi yang Paripurna: Studi Kasus Penerimaan Negara Bukan Pajak Sektor Hulu Migas, Balance Vocation Accounting Journal, Vol. 3, No. 1, 2009.

Rahayu S.A.P., Prinsip Hukum dalam Kontrak Kerja Sama Kegiatan Usaha Hulu Migas dan Minyak Bumi, Yuridika, Vol. 32, No. 2, 2017.

Roziqin, Pengelolaan Sektor Minyak Bumi di Indonesia Pasca Reformasi: Analisis Konsep Negara Kesejahteraan, Jurnal Tata Kelola & Akuntabilitas Keuangan Negara, 2015, hal. 128-140.

Rokhim, Hubungan Kontraktual antara Pemerintah dan Kontraktor Swasta dalam Kontrak Pertambangan Minyak dan Gas Bumi, Rechtidee, Vol.12, No. 1, Juni 2017, hal. 27-46.

Rulandari et. al.,Valuation of Production Sharing Contract Cost Recovery vs. Gross Split in Earth Oil and Gas Cooperation Contract in Indonesia and the Aspect of Public Services. IOP Conference Series: Journal of Physics Series 1114(2018) 012132, 2018.

Santoso & Nugroho, Pemanfaatan Penerimaan Negara Bukan Pajak di Bidang Kehutanan dalam Melestarikan Fungsi Lingkungan, Mimbar Hukum, Vol. 21, No. 3, 2009.

Sihotang, A Longitudinal Analysis of the Indonesian Production Sharing Contract (PSC): The Question of Economic Accountability, Journal the Winners, Vol. 4, No. 2, 2013.

Busro & Priyono Utomo, Aspek Hukum Penerapan Asas Kekuatan Mengikat dalam Kontrak Bagi Hasil Minyak dan Gas Bumi di Indonesia, Diponegoro Law Journal, Vol. 5, No. 4, 2016.

Pustaka Primer:

Undang-undang Nomor 8 Tahun 1971 tentang Perusahaan Pertambangan Minyak dan Gas Bumi Negara

Undang-Undang Nomor 20 tahun 1997 tentang Penerimaan Negara Bukan Pajak (PNPB).

Undang-Undang Nomor 21 tahun 2001 tentang Otonomi Khusus bagi Provisin Papua

Undang-Undang Nomor 1 tahun 2004 tentang Pembendaharaan Negara.

Peraturan Pemerintah No. 22 tahun 2005 tentang Pemeriksaan Penerimaan Negara Bukan Pajak (PNBP)

Peraturan Pemerintah Nomor 29 Tahun 2009 tentang Tata Cara Penentuan Jumlah, Pembayaran, dan Penyetoran Penerimaan Negara Bukan Pajak.

Peraturan Pemerintah Nomor 79 tahun 2010 tentang Biaya Oprasi Yang Dapat Dikembalikan dan Perlakuan Pajak Penghasilan di Bidang Usaha Hulu Minyak dan Gas Bumi.

Permen ESDM No 8 Tahun 2017 mengenai kebijakan mengganti skema PSC (Production Sharing Contract) atau Cost Recovery menjadi skema Gross Split.

Pustaka dalam bentuk CD-ROM:

Ariana Novizas Shebubakar, Penerapan Hukum Pajak terhadap Uplift dalam Sektor Migas di Indonesia, Disertasi, Universitas Indonesia, 2016.

Ocktarani, Analisis Kebijaka Pajak pada Industri Minyak dan Gas Bumi Guna Mendorong Investasi, Perbandingan dengan Malaysia dan Thailand, Tesis, Universitas Indonesia, 2016, hal 93-96.

Pustaka berasal dari situs internet:

Badan Pemeriksa Keuangan RI, 2017, Pengawasan atas Pendapatan Bagi Hasil Migas Perlu Dilakukan dengan optimal, diunduh dari https://www.bpk.go.id/news/pengawasan-atas-pendapatan-bagi-hasil-migas-perlu-dilakukan-secara-optimal pada 18 Juni 2020

Direktorat Jenderal Anggaran, Pengelolaan Penerimaan Negara Bukan Pajak (PNBP), 2017, diakses http://www.anggaran.depkeu.go.id/content/Publikasi/bimtek%20mataram/2017%20-%204%20Pengelolaan%20PNBP%20KL.pdf.

Direktorat Dana Perimbangan Kementerian Keuangan RI, Buku Pegangan Pengalokasian Dana Bagi Hasil Sumber Daya Alam, 2017, http://www.djpk.kemenkeu.go.id/wp-content/uploads/2017/06/Buku-Pegangan-Perhitungan-Alokasi-DBH-SDA.pdf

PricewaterhouseCoopers, The Pressure in on Investor Survey of the Indonesian Oil and Gas Industry, Jakarta, Mei, 2010.

Pustaka yang tidak dipublikasi:

Gunadi, Sambutan Pengantar dalam Diskusi Disinsentif Fiskal dalam Proses Bisnis Hulu Migas, Tax Centre Universitas Indonesia, November 2016, tidak dipublikasikan

Downloads

Published

Issue

Section

License

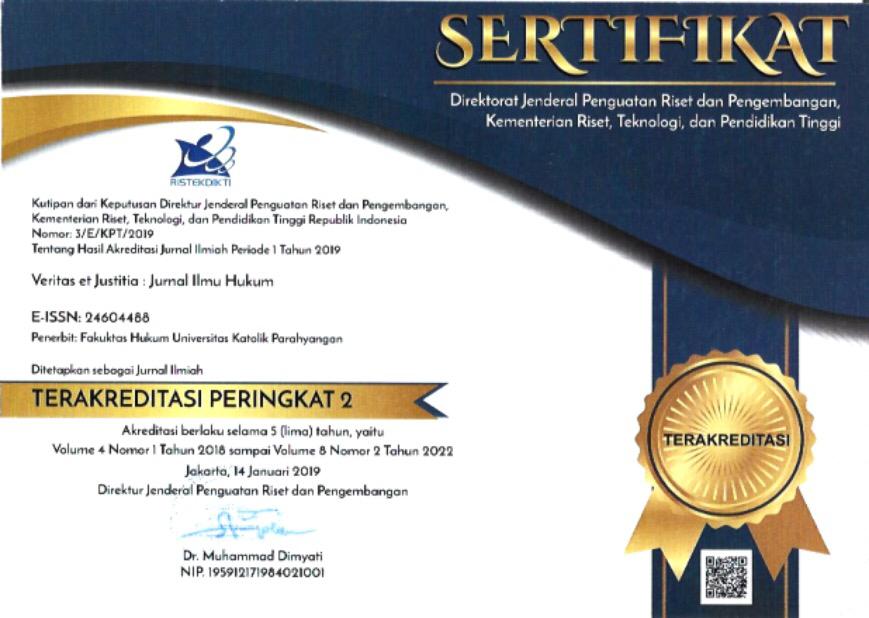

Copyright (c) 2021 Veritas et Justitia

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Authors who publish with this journal agree to the following terms:

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

The Journal allow the author(s) to hold the copyright and to retian publishing rights without restrictions.