ASPEK HUKUM PENAWARAN UMUM EFEK SECARA ELEKTRONIK

DOI:

https://doi.org/10.25123/vej.v7i1.4248Keywords:

Financial Services Authority, electronic public offering, legal protection of investors.Abstract

The main issue discussed here, using a juridical normative method, regards the legal validity and implementation of, and legal protection given to investors, found in the Financial Services Authority Regulation No. 41/POJK.04/2020 re. Electronic Public Offering of Equity, Debt Securities and/or Syaria’ Undivided Share. Important to note is the fact that the Financial Services Authority is established by virtue of Law No. 21 of 2011 to replace and take over the functions of the Capital Market and Financial Institution Supervisory Agency and the Central Bank in regulating and supervising Indonesian Banks and Capital Markets and lastly protect consumers in the financial services industry. Here should also mentioned the fact that the Capital Market Law (No. 8/1995) and its implementing regulations has yet to respond to how advances in information technology can be utilized to regulate-control and supervise public offering of shares or equity in the Capital Market.

References

Buku:

Andrian Sutedi, Aspek Hukum Otoritas Jasa Keuangan, Raih Asa Sukses, Jakarta, 2014.

Mas Rahmah, Hukum Pasar Modal, Kencana, Jakarta, 2019

Philipus M. Hadjon, Perlindungan Hukum Bagi Rakyat di Indonesia, Bina Ilmu, Surabaya, 1987

Peter Mahmud Marzuki, Penelitian Hukum (Edisi Revisi), Kencana, Jakarta, 2015

Sunariyah, Pengantar Pengetahuan Pasar Modal, UPP AMP YKPN, Yogyakarta, 2011

Jurnal:

Hilda Hilmiyah Dimyati. Perlindungan Hukum bagi Investor dalam Pasar Modal. Jurnal Cita Hukum Vol. II No. 2, Desember 2014. Jakarta: Fakultas Syariah dan Hukum Universitas Islam Negeri Syarif Hidayatullah.

Indra Safitri. Peranan Hukum Pasar Modal dalam Perkembangan Ekonomi Indonesia. Jurnal Legislasi Indonesia, Vol. 5 No. 2, Juni 2008.

Rochani Urip Salami. Hukum Pasar Modal dan Tanggung Jawab Sosial. Jurnal Dinamika Hukum Vol. 11 No. 3, September 2011. Fakultas Hukum Universitas Jenderal Soedirman.

Vidya Noor Rachmadini. Perlindungan Hukum bagi Investor dalam Pasar Modal menurut Undang-Undang Pasar Modal dan Undang-Undang Otoritas Jasa Keuangan. Jurnal Pena Justitia: Media Komunikasi dan Kajian Hukum Vol. 18, No. 1 Tahun 2019. Fakultas Hukum Universitas Pekalongan.

Zaenah. Aspek Hukum dalam Penerapan Prinsip Full Disclosure di Pasar Modal. Lex Journal: Kajian Hukum dan Keadilan Vol. 1 No. 2 Tahun 2017. Fakultas Hukum Universitas Dr. Soetomo Surabaya.

Peraturan Perundang-undangan:

Undang-Undang Republik Indonesia Nomor 8 Tahun 1995 tentang Pasar Modal.

Undang-Undang Republik Indonesia Nomor 12 Tahun 2011 tentang Pembentukan Peraturan Perundang-Undangan.

Undang-Undang Republik Indonesia Nomor 21 Tahun 2011 tentang Otoritas Jasa Keuangan.

Peraturan Otoritas Jasa Keuangan Nomor 41/POJK.04/2020 tentang Pelaksanaan Kegiatan Penawaran Umum Efek Bersifat Ekuitas, Efek Bersifat Utang, dan/atau Sukuk secara Elektronik.

Surat Edaran Otoritas Jasa Keuangan Republik Indonesia Nomor 15/SEOJK.04/2020 tentang Penyediaan Dana Pesanan, Verifikasi Ketersediaan Dana, Alokasi Efek untuk Penjatahan Terpusat, dan Penyelesaian Pemesanan Efek dalam Penawaran Umum Efek Bersifat Ekuitas Berupa Saham secara Elektronik.

Lain-lain:

Ringkasan Peraturan Otoritas Jasa Keuangan Nomor 41/POJK.04/2020 tentang Pelaksanaan Kegiatan Penawaran Umum Efek Bersifat Ekuitas, Efek Bersifat Utang, dan/atau Sukuk secara Elektronik.

Surat Keputusan Direksi PT Bursa Efek Indonesia No. Kep-00051/BEI/08-2020 perihal Pedoman Partisipan Sistem dalam Menggunakan Sistem Electronic Indonesia Public Offering yang Disediakan oleh PT Bursa Efek Indonesia.

Internet:

https://www.idx.co.id/berita/press-release-detail/?emitenCode=1344

https://www.idx.co.id/footer-menu/tautan-langsung/daftar-istilah/#glossaryE,

Downloads

Published

Issue

Section

License

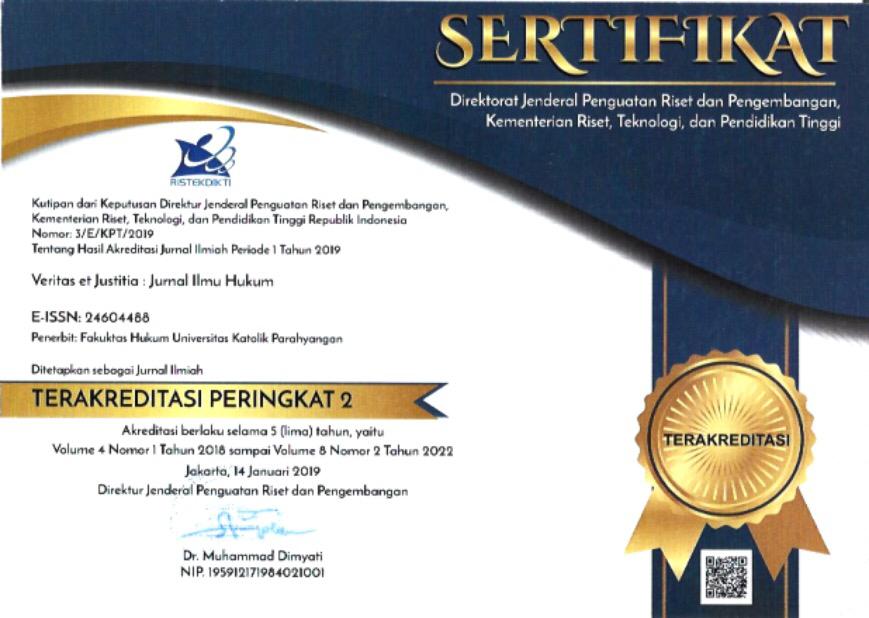

Copyright (c) 2021 Veritas et Justitia

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Authors who publish with this journal agree to the following terms:

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

The Journal allow the author(s) to hold the copyright and to retian publishing rights without restrictions.