KRISIS DAN REFORMASI: EKSPROPRIASI DALAM PERJANJIAN INVESTASI BILATERAL DI NEGARA DUNIA KETIGA

DOI:

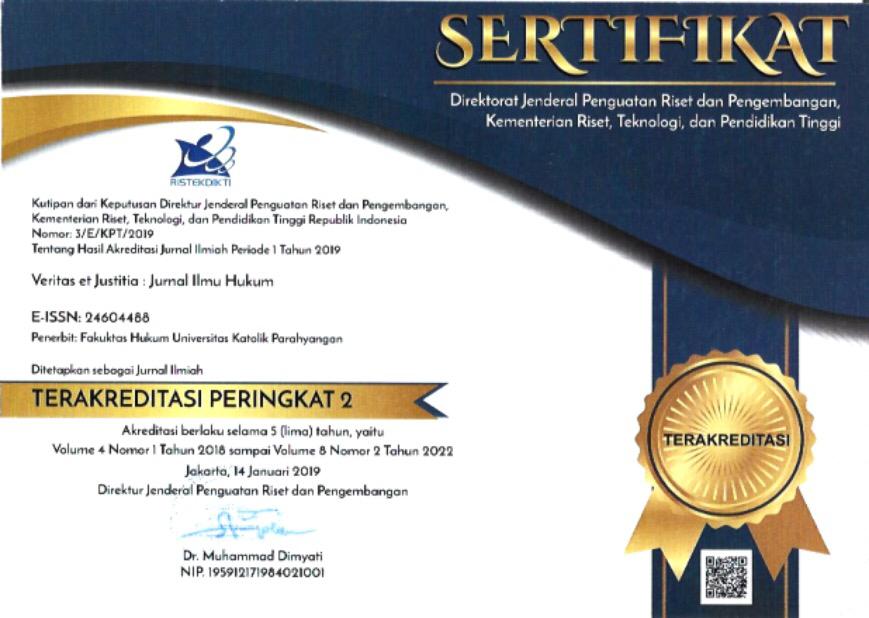

https://doi.org/10.25123/vej.v9i2.6249Kata Kunci:

expropriation; bilateral investment treaty; global south.Abstrak

Since its inception, expropriation has always been controversial. In the present time, amidst the crisis and reform of bilateral investment treaties (BIT), expropriation has become increasingly complex in theory and practice. Theoretically, for instance, there is no clear boundary between expropriation that requires compensation, and the right to regulate similar to expropriation but does not require compensation. This situation becomes more complicated due to the problem of inconsistency and incoherence of arbitral awards. Therefore, it is important to understand how the concept of expropriation is understood by experts and interpreted by the arbitration tribunal; while also comparing how the global south use that concept within their BITs (in this case, India, Brazil, South Africa) to find best-practices. The method used in this research is juridical-normative and comparative. Amidst the BIT’s crisis particularly regarding expropriation, the global south has made various attempts to reform its BIT model. Exceptions forexpropriation are included within the right to regulate. Expropriation and the right to regulate indeed have similar legal requirements (i.e.: pursuance of a public interest, non-discriminatory manner, due process of law) yet different legal effect regardingthe payment of compensation as another condition for expropriation vis-à-vis the absence of compensation inthe right to regulate. In general, taking into account the respective adjustments, the global south is relatively balancing the investment interest vis-a-vis public interest by modernizing the concept of expropriation in their BITs.

Referensi

Buku:

August Reinich, “Expropriation”, in The Oxford Handbook of International Investment Law, ed. Peter Muchlinski et al, Oxford University Press, Oxford, 2008.

Bryan A, Garner, Black’s Law Dictionary, West Publisher, Eagan, 2004.

Jeswald W. Salacuse, The Law of Investment Treaties, Oxford University Press, Oxford, 2021.

Jonathan Bonnitcha et.al, The Political Economy of the Investment Treaty Regime, Oxford University Press, Oxford, 2017.

M. Sornarajah, Resistance and Change In the Law of Foreign Investment, Cambridge University Press, Cambridge, 2015.

M. Sornarajah, The International Law on Foreign Investment Cambridge University Press, Cambridge, 2010.

Rudolf Dolzer dan Christoph Schreuer, Principles of International Investment Law, Oxford University Press, Oxford, 2008.

Stephan W. Schill, The Multilateralization of International Investment Law, Cambridge University Press, Cambridge, 2009.

Sundhya Pahuja, Decolonising International Law: Development, Economic Growth, and Politics of Universality, Cambridge University Press, Cambridge, 2011.

Surya Subedi, International Investment Law: Reconciling Policy and Principle, Hart Publishing, Portland, 2008.

Jurnal:

Abdulkadir Jailani, Indonesia's Perspective on Review of International Investment Agreements, Investment Policy Brief, South Centre, 6, 1-6, 2015.

Andrew Newcombe, The Boundaries of Regulatory Expropriation in International Law, Volume 20, Issue 1, Spring, ICSID Review - Foreign Investment Law Journal, 52, 17, 2005.

Christian Riffel, Indirect Expropriation and The Protection of Public Interest, Vol 71 Issue 4, International & Comparative Law Quarterly, 30 (946-974), 946, 2022.

M. Ya’kub Aiyub Kadir, Hull Formula and Standard of Compensation for Expropriation in Postcolonial States, Vol. 19 No. 2, Kanun Jurnal Ilmu Hukum. 248, 237-238, 2017.

OECD, Indirect Expropriation and the Right to Regulate In International Investment Law, OECD Working Papers on International Investment, 22, 3, 2004.

Susan D. Frank, The Legitimacy Crisis in Investment Treaty Arbitration: Privatizing Public International Law Through Inconsistent Decisions, Vol. 73, Fordham Law Review, 1625, 2005.

Suzy H. Nikièma, Best Practices Indirect Expropriation, IISD Best Practices Series, 22, 3, 2012.

UNCTAD, Expropriation, UNCTAD Series on Issues in International Investment Agreements II, New York and Geneva, 166, 5, 2012.

UNCTAD, International Investment Agreements and Their Implications for Tax Measures: What Tax Policymakers Need to Know, 46, 30, 2021.

UNCTAD, World Investment Report: Investing In Sustainable Energy for All, New York and Geneva, 205, 71-72, 2023.

Peraturan Peraturan:

Afrika Selatan. Protection of Investment Act 22 of 2015.

Brazil Agreement on Cooperation and Facilitation of Investments (ACFI) 2015.

Brazil-Finland BIT (1995)

France-Argentina BIT (1999)

India Model BIT 2016

Peraturan Presiden R.I, Nomor 97 Tahun 2020, Tentang Persetujuan Antara Pemerintah Repulik Indonesia Dan Pemerintah Republik Singapura Mengenai Peningkatan dan Perlindungan Penanaman Modal, Perpres 97/2000, LN.2020/No.215.

South Africa Model BIT (1998)

Putusan Arbitrase Internasional:

Biloune v. Ghana, Award on Jurisdiction and Liability, 27 October 1989.

Fireman’s Fund v. Mexico, Award, 7 July 2006, para. 76(f).

GAMI Investments v. Mexico, Award, 5 November 2004, paras. 4–5.

Nykomb v. Latvia, Award, 6 December 2003, para. 4.3.

Pope & Talbot v. Canada, Interim Award, 26 June 2000, para. 02.

SD Myers v. Canada, First Partial Award, 3 November 2000, paras. 287–288.

Sedco, Inc. v. National Iranian Oil Company, Interlocutory Award, 28 October 1985, 9 the Iran-United States Claims Tribunal Reports 248, p. 278.

Sempra Energy v. Argentina, Award, 28 September 2007, para. 285.

Tecmed v. Mexico, Award, 29 May 2003, para. 6.

Vivendi v. Argentina II, Award, 20 August 2007, para. 7.5.11.

Putusan Mahkamah Internasional:

Elettronica Sicila S.p.A. (ELSI) v. United States of America, International Court of Justice, Judgment, 20 July 1989, para. 28

##submission.downloads##

Diterbitkan

Terbitan

Bagian

Lisensi

Hak Cipta (c) 2023 Syahrul Fauzul Kabir

Artikel ini berlisensi Creative Commons Attribution-NonCommercial 4.0 International License.

Authors who publish with this journal agree to the following terms:

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

The Journal allow the author(s) to hold the copyright and to retian publishing rights without restrictions.