URGENSI PENGATURAN HUKUM CENTRAL BANK DIGITAL CURRENCY DALAM DIMENSI ANTI PENCUCIAN UANG

DOI:

https://doi.org/10.25123/vej.v8i1.4520Keywords:

Payment Systems; Central Bank Digital Currency; Anti Money Laundering Regime; Legal FrameworkAbstract

The issue of digitalized forms of payment systems has required adjustment from a State to accomodate and respond. One of the issues is concerning the use of virtual currencies, and Central Bank Digital Currency. It requires the accomodative and responsive of the law instruments in Indonesia to arrange that issue. The payment systems’ policy in Indonesia has not placed any issues of crypto/digital currency as one of the payment methods. Central Bank Digital Currency is a the digital form of fiat money. Through the Bank Indonesia Regulation Number 18/40/PBI/2016 concerning Operation of Payments Transaction Processing, and Bank Indonesia Regulation Number 19/12/PBI/2017 concerning the Implementation of Financial Technology, it can be understood that Indonesia remain bans the use of any virtual currency as payment instruments. Central Bank Digital Currency has different form of virtual currencies which are not issued by the state, but it is remain called as virtual currencies. In fact, the use of virtual currencies has been exploited by money launderer to do laundering. Virtual currencies has no underlying asset or responsible authority or administrator, volatile, risky, and speculative. This article is a normative legal research method that will analyzed the direction in which Indonesian Law can headed Central Bank Digital Currency while the option has become more less for not response it. The result of this research has showed that it is urgently need for Bank Indonesia (as a central bank in Indonesia) to recognise Central Bank Digital Currency as payment’s instrument.

References

Buku:

Arief Amrullah, Tindak Pidana Pencucian Uang Money Laundering: Reorientasi kebijakan Penanggulangan dan Kerjasama Internasional. Malang, Bayumedia Publishing, 2004

Asian Development Bank Institute, “Central Bank Digital Currency and FinTech in Asia”, edited by Marlene Amstad, Bihong Huang, Peter J. Morgan, and Sayuri Shirai, Asian Development Bank Institute, 2019

Hanafi Amrani, Hukum Pidana Pencucian Uang: Perkembangan Rezim Anti Pencucian Uang dan Implikasinya terhadap Prinsip Dasar Kedaulatan Negara, Yurisdiksi Pidana dan Penegakan Hukum, UII Press, Yogyakarta, 2015

Reda Mathovani, dan R. Narendra Jatna, Rezim Anti Pencucian Uang dan Perolehan Hasil Kejahatan di Indonesia, Malibu, Jakarta, 2011

Sulistiyowati Irianto & Shidarta (ed), Metode Penelitian Hukum Konstalasi dan Refleksi, Yayasan Obor Indonesia, Jakarta, 2009

Artikel Dalam Jurnal dan Buletin:

Apolline Blandin, et.al, The Global Crypto Asset Regulatory Landscape Study, The University of Cambridge: Judge Business Law, London, 2019

Bryan Zhang, et.al., Early Lessons on Regulatory Innovation to Enable Inclusive Fintech. The University of Cambridge: Judge Business Law, London, 2019

Camila Amalia, Kerangka Pengaturan Crypto Currency dalam mencapai Tujuan Regulator di Sektor Jasa Keuangan, Buletin Hukum Kebanksentralan, Volume 16, No. 1, Januari-Juni 2019

Christina Barontini and Henry Holden, No Proceeding with Caution – A survey on Central Bank Digital Currency: Monetary and Economic Department, Bank for International Serttlement, BIS Papers, 2019

European Central Bank Eurosystem, Exploring Anonymity in Central Bank Digital Currencies, In Focus Issue No.4, December 2019,

John Mc Dowell, and Gary Novis, ‘The consequences of Money Laundering and Financial Crime’, Economic Perspective: The Fight Against Money Laundering. Electronic Journal of the Office of International Information Program (IIP), U.S Department of State, 2001

Náñez Alonso, S.L.; Jorge-Vazquez, J.; Reier Forradellas,R.F., Central Banks Digital Currency:Detection of Optimal Countries forthe Implementation of a CBDC andthe Implication for Payment Industry Open Innovation. J. Open Innov. Technol. Mark. Complex.2021,7, 72. https://doi.org/10.3390/joitmc7010072

Sayuri Shirai, Money and Central Bank Digital Currency, ADBI Working Paper Series, ADBI: Japan, 2019

Tania Ziegler, et.al., Shifting Paradigms: The 4th European Alternative Finance Benchmarking Report. The University of Cambrigde: Judge Business Law, London, 2019

Yaya J. Fanusie and Emily Jin, China’s Digital Currency Adding Financial Data To Digital Authoritarianism, Energy, Economic & Security, Bulletin, January 2021

Web Dokumen:

Andrew Tarpey, The Money Laundering Risk of Cryptocurrencies, Article, diakses dari www.southpacgroup.com, pada tanggal 4 Agustus 2019

James T. Arredy, China Creates Its Own Digital Currency, a First for Major Economy, diakses dari: https://www.wsj.com/articles/china-creates-its-own-digital-currency-a-first-for-major-economy-11617634118, tanggal 5 Juni 2021

Morten Bench and Rodney Garrat., Central Bank Cryptocurrencies, BIS Quarterly Review, September 2017, diakses dari https://www.bis.org/publ/qtrpdf/r_qt1709f.pdf diakses pada 6 Agustus 2019

Robby Houben and Alexander Snyers, Cryptocurrencies and Blockchain: Legal Context and implication for financial crime, money laundering and tax evasion, European Parliament, 2018, diakses dari https://www.europarl.europa.eu/cmsdata/150761/TAX3%20Study%20on%20cryptocurrencies%20and%20blockchain.pdf

Siaran Pers OJK: Penerapan Mata Uang Digital Masih Memerlukan Kajian, diakses https://www.ojk.go.id/id/berita-dan-kegiatan/siaran-pers/Documents/Pages/Siaran-Pers-OJK-Penerapan-Mata-Uang-Digital-Masih-Perlu-Kajian/Siaran%20Pers%20OJK%20Penerapan%20Mata%20Uang%20Digital%20Masih%20Perlu%20Kajian.pdf

https://www.bi.go.id/id/publikasi/ruang-media/news-release/Pages/sp_200418.aspx, 2018

https://www.bis.org/speeches/sp210127.pdf

https://www.kevinrooke.com/post/what-are-central-bank-digital-currencies

https://www.raconteur.net/finance/cryptocurrency/digital-currencies-cbdcs/

https://www.indonesia-investments.com/finance/financial-columns/bank-indonesia-studies-the-use-of-central-bank-digital-currency/item8570, pada 6 Februari 2020

Peraturan Perundang-undangan:

Undang-Undang Nomor 23 Tahun 1999 tentang Bank Indonesia, yang kemudian diubah dengan UU No. 3 Tahun 2004 tentang Perubahan atas Undang-Undang Republik Indonesia Nomor 23 Tahun 1999, yang kemudian diubah UU No. 6 Tahun 2009 tentang Penetapan Peraturan Pemerintah Pengganti Undang-Undang Nomor 2 Tahun 2008 tentang Perbuahan Kedua Atas Undang Undang Nomor 23 Tahun 1999 tentang Bank Indonesia menjadi Undang-Undang

Undang-Undang Nomor 8 Tahun 2010 tentang Pencegahan dan Pemberantasan Tindak Pidana Pencucian Uang

PBI No. 20/6/PBI/2018 tentang Uang elektronik

PBI No. 18/40/PBI/2016 tentang Pelaksanaan Proses Transaksi Pembayaran

PBI No. 19/12/PBI/2017 tentang Penyelenggaraan Teknologi Finansial

Downloads

Published

Issue

Section

License

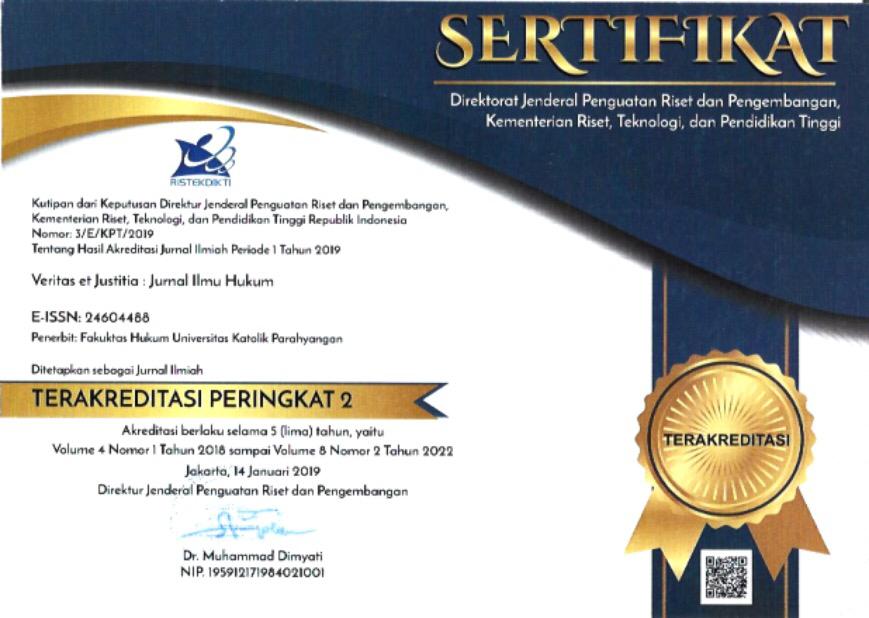

Copyright (c) 2022 Veritas et Justitia

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Authors who publish with this journal agree to the following terms:

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

The Journal allow the author(s) to hold the copyright and to retian publishing rights without restrictions.