BRANCH PROFIT OF UPSTREAM OIL AND GAS BASED ON TAX TREATY AND PRODUCTION SHARING CONTRACT IN INDONESIA

DOI:

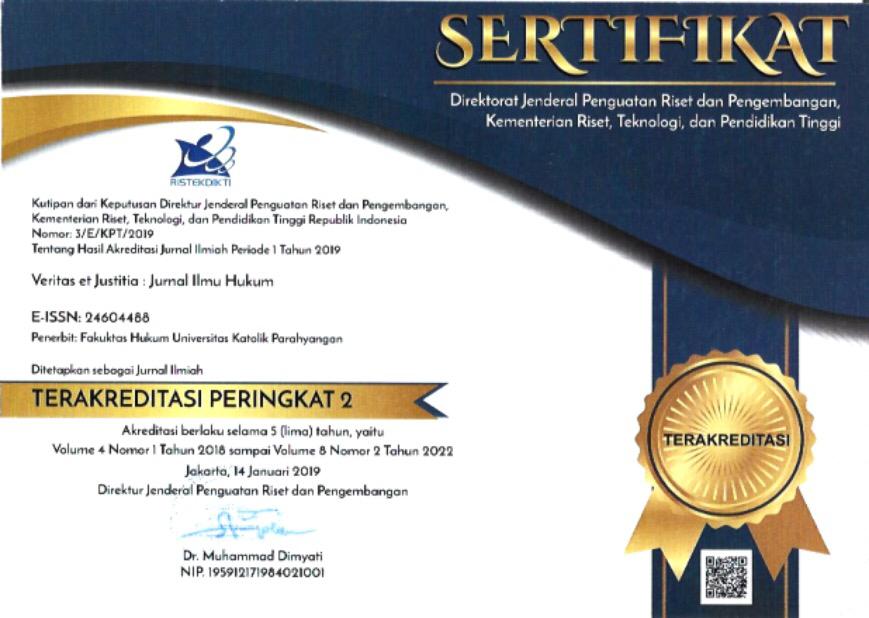

https://doi.org/10.25123/vej.v10i1.6538Kata Kunci:

branch profit tax; production sharing contract; tax treaty; withholding taxAbstrak

Tax treatment for a production sharing contract (PSC) is possibly different from general tax rules when calculating the amount of annual cost to be allocated by upstream oil and gas business to project their profit. On the other hand, the prevailing tax law applied in a particular country could either be made based on domestic tax law and a tax treaty depends on the tax subject. This article is intended to discuss tax arrangements sourced by a PSC during cost recovery regime and tax treaties in Indonesia. This study also discusses the cases brought before the Supreme Court due to the interplay of a PSC and a tax treaty during the years of 2015-2021. The research uses normative legal research with data collected through documentation studies. The contractors demanded a reduced tax rate on branch profit derived from a tax treaty as a general rule considering that they are the persons covered by the treaty. However, they must also respect production sharing as agreed in a PSC that existed before the conclusion of the tax treaty. For the future, it needs to adopt the stabilization clause to deal with the issue.

Referensi

Books:

Burns, Lee, and Richard Krever. "16 Taxation of Income from Business and Investment". In Tax Law Design and Drafting, Volume 2, (USA: International Monetary Fund, 1998) accessed May 10, 2022, https://doi.org/10.5089/9781557756336.071.ch016

Erman Rajagukguk, Hukum Investasi: Penanaman Modal Asing (PMA) dan Penanaman Modal Dalam Negeri (PMDN), Raja Grafindo Persada, 2019

Hernoko Agus Yudha, Asas Proporsionalitas dalam Kontrak Komersial. Edisi 1. Yogyakarta: Laksbang Mediatama dan Koantor Advokad Hufron & Hans Simalea, 2, 2008

Jaja Zakaria, Perlakuan Perpajakan terhadap Bentuk Usaha Tetap, (Jakarta: PT. Raja Grafindo Persada, 2007.

Kamal Hossain, Law and Policy in Petroleum Development: Changing Relations between Transnationals and Governments, London: Francis Publishers Ltd, 1979.

Rachmanto Surahmat, Persetujuan Penghindaran Pajak Berganda: Suatu Kajian terhadap Kebijakan Indonesia, Indonesia, Salemba Empat, 2011.

Rinto Pundyantoro, A to Z Bisnis Hulu Migas, Jakarta: Petromindo, 2012,

Rudi M. Simamora, Hukum Minyak dan Gas Bumi, Jakarta: Djambatan, 2000.

Nurmala Manik, Kajian Pengenaan Pajak Penghasilan atas Sektor Migas di Indonesia, Master Thesis, Department of Administrative Science, Faculty of Social and Political Science, Universitas Indonesia, 2003.

UN Model Tax Convention, retrieved from https://www.un.org/esa/ffd/wp-content/uploads/2018/05/MDT_2017.pdf.

UN Model Tax Convention Art. 10, retrieved from https://www.un.org/esa/ffd/wp-content/uploads/2018/05/MDT_2017.pdf.

Articles:

Abba Kolo, Thomas W. Wälde, 'Investor-State Disputes: The Interface Between Treat-Based International Investment Protection and Fiscal Sovereignty', 35 Intertax, Issue 8,424-449, 2007, https://kluwerlawonline.com/journalarticle/Intertax/35.8/TAXI2007049.

Arba Maulana, Penerapan Asas Proporsonalitas dalam Production Sharing Contract pada Kegiatan Usaha Pembangunan Pertambangan Hulu Migas dan Gas Bumi. Diponegoro Law Review, 5(2), 2016.

OECD, Tax Treaty Design for Resources-Rich Developing Countries. Retrieved from https://www.oecd.org/dev/Session_1_%20Tax_Treaty_Design%20for_Resource-Rich_Countries_Zero_Draft.pdf on 24 September 2021.

OECD, Are the Current Treaty Rules for Taxing Business Profit Appropriate for E-Commerce? Final Report, Centre for Tax Policy and Administration, https://www.oecd.org/tax/treaties/35869032.pdf (accessed at 17 February 2022).

Websites:

Badan Pemeriksa Keuangan, Badan Pemeriksa Keuangan Temukan Masalah Pajak Minyak dan Gas Bernilai Rp. 1,12 Triliun,(2014), retrieved from https://jdih.bpk.go.id/wp-content/uploads/2015/05/BPK-Temukan-Masalah-Pajak-Migas-Bernilai-Rp-112-Triliun.pdf.

Chandra Budi, Mengakhiri Polemik Pajak Migas, 2008, retrieved from https://www.pajak.go.id/artikel/mengakhiri-polemik-pajak-migas at 14th January 2021.

Detik Finance, Perusahaan Migas dan BPKP Beda Hitungan soal Tunggakan Pajak, 2011, retrieved from https://finance.detik.com/energi/d-1685108/perusahaan-migas-dan-bpkp-beda-hitungan-soal-tunggakan-pajak- at 14th January 2021.

Nadia Kurnia, Tiga Perusahaan Migas Tunggu SKP untuk Bayar Pajak, 2011, retrieved from https://ekonomi.bisnis.com/read/20110720/44/42922/3-perusahan-migas-tunggu-skp-untuk-bayar-pajak at 14th January 2021.

PricewaterhouseCoopers, Same Difference: Dividend and Branch Profit, 2020,retrieved from https://www.pwc.com/ph/en/taxwise-or-otherwise/2020/same-difference-dividends-and-branch-profits.html.

PriceWaterhouseCoopers, The Urgency of Building Competitiveness to Attract Oil and Gas Investment, Jakarta, 2015.

Agreement between the Government of the Republic of Indonesia and the Government of the Kingdom of the Netherlands, retrieved from https://www.pajak.go.id/id/p3b/belanda.

Regulations:

Ministry of Finance No. S-443a/MK-012/1982 dated 6 Mei 1982 with regard to Interpretation of Ministry of Finance Regulation No. 267/KMK.012/1978 regarding Procedures for Calculating and Paying Corporation Tax and Tax Against Interest, Dividend and Royalty.

Tax Court Decision

Tax Court Decision No. 096970.13/2011/PP/M.VIIIA 2019.

Tax Court Decision No. 82032/PP/M.VIIIA/13/2017.

Tax Court Decision No. 82034/PP/M.VIIIA/13/2017.

Tax Court Decision No. 110171.36/2013/PP/M.XVIA.

Tax Court Decision No. 091728.36/2010/PP/M.XIIIA.

Tax Court Decision No. 109140.36/2011/PP/MIIA.

Tax Court Decision No. 90537/PP/M.VIA/36/2017.

Tax Court Decision No. 108165.36/2013/PP/M.XIIIA.

Tax Court Decision No. 102925.36/2011/PP/M.XIIIA.

Tax Court Decision No. 80953/PP/M.XIVA/13/2017.

Tax Court Decision No. 80952/PP/M.XIVA/13/2017.

Tax Court Decision No. 109140.36/2011/ PP/M.IIA/2018.

Tax Court Decision No. 110339.36/2010/PP/M.VA/2018

Tax Court Decision No. 87275/PP/M.IIA/13/2017

Tax Court Decision No. 65544/PP/M.VIB/13/2015

Tax Court Decision No. 001917.36/2018/PP/M.IA

Tax Court Decision No. 117426.36/2011/PP/M.IA

Supreme Court Decision

Supreme Court Decision No. 368/B/PK/Pjk/2020.

Supreme Court Decision No. 435/B/PK/Pjk/2020.

Supreme Court Decision No. 716/B/PK/Pjk/2020.

Supreme Court Decision No. 750/B/PK/Pjk/2020.

Supreme Court Decision No. 751/B/PK/Pjk/2020.

Supreme Court Decision No. 1324/B/PK/Pjk/2020.

Supreme Court Decision No. 1346/B/PK/Pjk/2020.

Supreme Court Decision No. 506/B/PK/Pjk/2019.

Supreme Court Decision No. 1432/B/PK/Pjk/2019.

Supreme Court Decision No. 3338/B/PK/Pjk/2019.

Supreme Court Decision No. 3814/B/PK/Pjk/2019.

Supreme Court Decision No. 4000/B/PK/Pjk/2019.

Supreme Court Decision No. 417/B/PK/Pjk/2018.

Supreme Court Decision No. 1851/B/PK/PJK/2017.

##submission.downloads##

Diterbitkan

Terbitan

Bagian

Lisensi

Hak Cipta (c) 2024 Maria R. U. D. Tambunan

Artikel ini berlisensi Creative Commons Attribution-NonCommercial 4.0 International License.

Authors who publish with this journal agree to the following terms:

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

The Journal allow the author(s) to hold the copyright and to retian publishing rights without restrictions.